By Agnes King

Energy retailers have embraced the inevitable with regards to consumer energy resources, with a spate of new deals aimed at luring consumers to hand over control of their rooftop solar and batteries for the sake of the system.

In a display of how the battle for consumer-owned energy resources is heating up, Origin Energy launched its new EV Power Up program this year, offering compatible EV owners a low 8c per kilowatt hour rate if they allow Origin to control when their electric vehicle charges.

Matthew van der Linden, Flow Power’s Chief Executive Officer says, “While traditional retailers are starting to integrate basic CER offerings into their plans, they need offer consumers incentives for optimising their usage and deliver value for their investments.”

Flow Power focuses on deeply integrating consumers, making CER a core part of product offerings. They believe that the rewards for participating are substantial, both for individual households and for the broader energy transition.

Solar PV and negative pricing

Consumer energy resources currently account for a quarter of the national electricity market.

“They are the reason we see negative spot prices,” Lance Hoch, Executive Director of energy consultancy, Oakley Greenwood, says.

Most of this is rooftop solar (21 gigawatts). Residential battery exports are minimal, and electric vehicles are contributing virtually nothing.

But adoption of all these technologies is trending upwards.

By 2050, about half of the NEM’s dispatchable capacity could be in the hands of consumers, according to the Australian Energy Market Operator’s 2024 Integrated System Plan. This includes resources orchestrated via virtual power plants (VPPs).

Control is key

While retailers might have preferred that the boom in consumer energy resources had never happened, they accept there is no stopping it now.

Dealing with it is key to maintaining market share, lowering costs and controlling revenue.

“Uncontrolled rooftop solar doesn’t help anybody,” Hoch says. “Although it does reduce wholesale prices, for retailers it means loss of revenue and creates complications in hedging and procuring energy.”

To get ahead of this, AGL established a dedicated electrification and innovation team to help customers electrify the way they live and access the potential benefits.

Earlier this year it released an advanced analytics tool, called Electrify Now, that offers personalised insights on the best home upgrades to reap the benefits of electrification based on energy usage.

“AGL was the first Australian energy retailer to use consumer data rights electricity data to estimate bill and carbon savings from upgrading to home electrification products,” Julie Hirsch, AGL’s Entrepreneur in Residence, Decarbonisation, says.

It has made this tool available to all households, regardless of whether they are AGL customers.

Incentives to drive uptake

Provided they can be controlled and corralled, consumer energy resources are expected to play an important role in stabilising the system and lowering the overall cost of the energy transition.

However, the conundrum for retailers is how to sufficiently sweeten deals so consumers allow them to control when their batteries and EVs charge, as well as when they dispatch excess power into the grid.

“The best way for consumers to use consumer energy resources is to reduce their power bill. The challenge for retailers, and the system as a whole, is to make it worthwhile to use consumer energy resources as a system asset,” Hoch says.

Consumers are not especially keen to give up control of their energy assets. Most of the time, they’re installing rooftop solar because they resent power companies, so why would they let them use it?

van der Linden emphasises the importance of engaging with customers and winning their trust.

“Industry has to recognise that the customer has made this potentially large investment in CER, and they could have made that decision for any number of reasons. You can’t start by presuming you know what’s best for that customer or how they wish to use their CER. Instead, you have to provide information and options for that customer to decide how or even if they wish to engage at all.”

Rewards and regulatory roadblocks

Labor and the Coalition are both looking at policies to spur household battery adoption which could remove some of this resistance. However, Hoch says NSW’s decision to reward participation in virtual power plants (VPPs) to manage peak demand, goes a step further.

Stephen England-Hall, Chief Customer Officer at Genesis Energy in New Zealand, points out that consumer energy resources are increasing steadily in New Zealand even without the generous subsidies offered to consumers across the ditch in Australia.

However, one of the biggest roadblocks to widespread adoption from a regulatory perspective is value sharing across the energy ecosystem.

“As consumers generate more energy through their own CERs, the question of how to distribute value fairly across the ecosystem becomes critical,” England-Hall says. “Electricity Distribution Businesses (EDBs) may need to invest in grid upgrades to accommodate DERs, and the cost of these upgrades needs to be balanced across all parties.”

At the same time, consumers expect to be compensated for the service they are providing to the system.

“Consumers who invest in CERs, like solar with battery storage, may not be compensated adequately for the services they provide to the grid, such as stabilising supply or reducing peak demand. Regulatory frameworks need to evolve to reflect the value CERs provide to the grid and ensure that customers receive fair compensation,” England-Hall says.

Taking customers on the journey

Evette Smeathers, Horizon Power’s Executive General Manager Customer & Community, has learned firsthand from an electrification project in Esperance just how important it is to bring customers on the journey.

Horizon delivered a transition of about 400 residents and businesses from reticulated gas to an alternative energy source when the gas supply to the town ceased last year.

“Overall, we had a 94% customer satisfaction rate, and the Esperance energy transition is serving as a blueprint for the rest of the country,” Smeathers says.

“A high level of customer engagement was needed to get to that point. We really needed to understand customer sentiment and pain points and communicate with them in a way that worked – this was largely in-person engagement.”

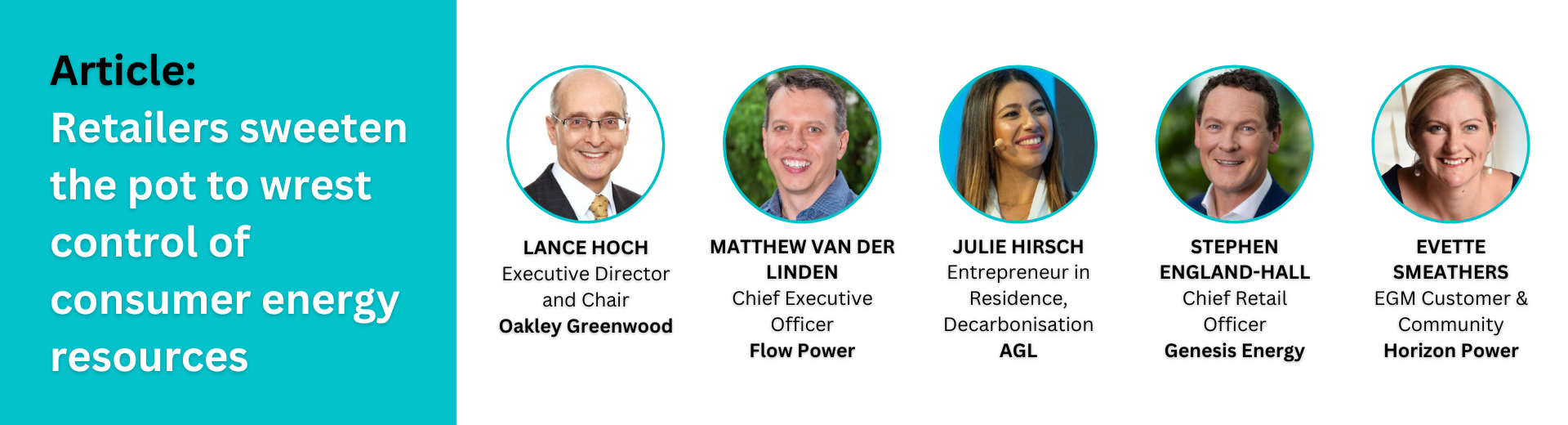

Lance Hoch (Oakley Greenwood), Matthew van der Linden (Flow Power), Julie Hirsch (AGL), Stephen England-Hall (Genesis Energy) and Evette Smeathers (Horizon Power) will join energy retailers Synergy, Origin, ENGIE, Aurora, Ergon and Momentum at the Energy Retail Excellence conference, sharing insights and approaches to energy customers through the transition. Learn more here.

To access the detailed conference program, download the brochure here.

For more energy content subscribe to the Energy Insights blog here.